Digital identities

Integration of the eID in relevant customer processes of the Sparkassen (e.g. new account creation as giroBooster process) as well as integration of a payment & SCA functionality based on the EU Wallet.

The challenges in the market confirm that SFG’s decision to proceed in two stages was correct

SFG institutes continue to be under high digitization and automation pressure. There is high efficiency potential in important customer processes

Successful, private identity ecosystems (new players and also BigTechs) integrate payment and banking into their identity ecosystems and thus penetrate the core business area of SFG as a further player.

Big and FinTechs such as PayPal, Apple, Klarna, Google, etc. are expanding their ecosystems to act as payment intermediaries between the SFG and the customer, skimming off a (large) share of the margin in payment transactions.

The solution: state digital identities

2022-23 DE- Initiative

2022-23 DE- Initiative

Digitale Identität

SMart eID (Standalone App)

Online-Ausweisfunktion

Digitale Behördengänge

Kontoneuanlage

2023-25 EU-Initiative

2023-25 EU-Initiative

Banking - Payment - Embedded Finance

EU-Wallet mit integrierter eID und vielen weiteren Nachweisen und Ausweisen, mit weitreichenden Verpflichtungen für die Finanzwirtschaft

Kontoeröffnung

Digitale Signatur

SCA

A2A und QR-basiertes SCT Instant Payment

Travel und Health mit A2A – Payments

Together grown everything

The economic, social and ecological challenges of the future are so great that they can only be solved by the European states working together. Economic separation, protectionism or retreat into national structures are not alternatives if we want to secure economic prosperity, freedom and sustainability.

We envision a Europe in which people do not have to choose between a regional, national and European identity, but can combine them well. Diversity enriches Europe.

The NOBID (Nordic-Baltic eID) consortium includes participants from 6 member states and focuses on the payment use case.

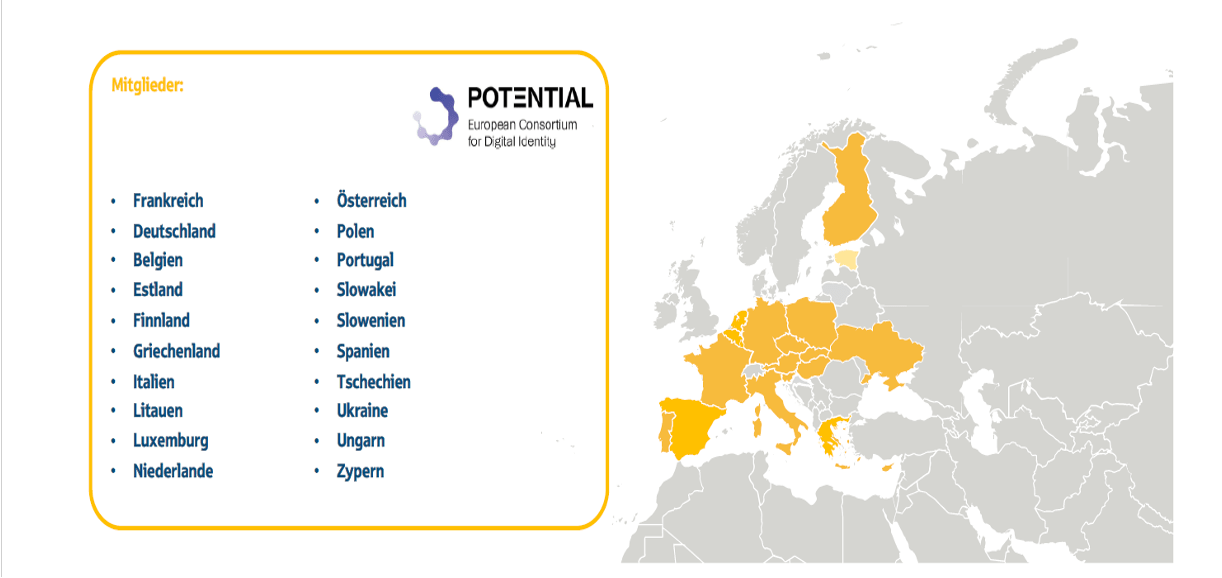

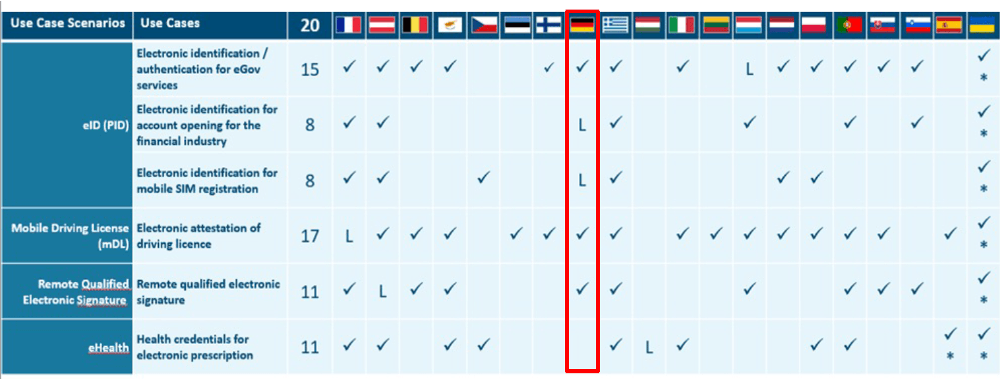

The POTENTIAL consortium (PilOTs for EuropeaN digiTal Identity wALlet) brings together 20 countries represented by their national ministries as well as third parties and aims to improve citizens’ access to trusted and secure electronic identity means and services such as electronic signatures or attestations of properties.

Digital account creation and legitimation with eID (GiroBooster)

The eID is a project of the Federal Ministry of the Interior. It enables citizens to identify themselves by ID card using their smartphone. The ID card is held up to the smartphone to transfer the data. Digital identification takes place via the AusweisApp2. The legitimation data is sent to the authorized service provider via an interface. The process is completed within a few seconds. Identification on the Internet thus becomes more practical and is thus significantly shortened.

The eID thus enables a complete digital account creation, which is already integrated in the SFG and can replace e.g. the Video-Ident-Legimition. The account creation process is optimized and accelerated (GiroBooster). This means that the new account creation via smartphone is completed within 1-2 minutes.

Integration of a payment and SCA functionality based on the EU Wallet

The EU is designing a wallet in a large-scale project in collaboration with various member states, digitization authorities and numerous companies from the banking and retail sectors. This wallet is to have its own A2A payment procedure in addition to the ID card data (such as the smart eID). Strong Customer Authentication (SCA) is also planned, which will enable payment approval via the wallet.

As part of the “Digital Identity Instruments” strategy, authentication via eID (or smart eID in the future) and EU wallet is to be made possible for various account management processes. These include, for example, logging into online banking and S apps, account unlocking, ordering PinTan access data, and general payment approval. For the customer, the process offers a secure and convenient authentication alternative to the existing S-PushTan app.